Money Laundering: Methods and Enforcement

”

Money laundering is the process of disguising the origins of illegally obtained money, typically by passing it through a complex sequence of banking transfers or commercial transactions.

This illegal practice allows criminals to integrate “dirty money” into the legitimate financial system, making it appear as though it came from legal sources. Money laundering is a global issue, often linked to organized crime, corruption, and terrorism financing.

Famous Methods of Money Laundering

- Smurfing (Structuring): Criminals break down large sums of money into smaller, less suspicious amounts and deposit them into multiple bank accounts to avoid detection.

- Shell Companies: Fake businesses are created to disguise illegal funds as legitimate income. These companies often exist only on paper and have no real operations.

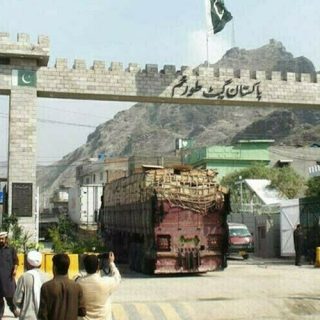

- Trade-Based Laundering: Over- or under-invoicing of goods and services in international trade is used to move money across borders while masking its origin.

- Cryptocurrencies: Digital currencies like Bitcoin are increasingly used to launder money due to their anonymity and decentralized nature.

- Real Estate Investments: Illicit funds are used to purchase property, which is then sold to convert the money into clean, legal assets.

- Casinos and Gambling: Criminals use casinos to convert cash into chips, play minimally, and then cash out with “clean” money.

How Law Enforcers Catch Money Launderers

Law enforcement agencies employ a combination of advanced technology, international cooperation, and regulatory frameworks to combat money laundering:

- Transaction Monitoring: Banks and financial institutions use software to detect unusual or suspicious transactions, such as frequent large deposits or rapid movement of funds.

- Know Your Customer (KYC) Regulations: Financial institutions are required to verify the identity of their clients, making it harder for criminals to use fake identities.

- Suspicious Activity Reports (SARs): Banks and businesses must report any suspicious financial activity to authorities for further investigation.

- International Cooperation: Agencies like INTERPOL and the Financial Action Task Force (FATF) facilitate cross-border collaboration to track and disrupt money laundering networks.

- Forensic Accounting: Experts analyze financial records to uncover hidden patterns or discrepancies that indicate laundering activities.

- Whistleblower Programs: Insiders or informants are incentivized to report illegal activities, providing critical leads for investigations.

- Blockchain Analysis: For cryptocurrency-related laundering, specialized tools are used to trace transactions on the blockchain, despite its perceived anonymity.

Money laundering poses a significant threat to global financial systems and economies.

While criminals continue to devise sophisticated methods to launder money, law enforcement agencies are leveraging technology, regulations, and international partnerships to stay ahead. Public awareness and robust legal frameworks remain essential in the fight against this financial crime, ensuring that illicit funds do not infiltrate the legitimate economy.

”