Behbood Savings Certificates latest profit rate-March 2025

”

The National Savings also known as Qaumi Bachat revised Behbood Savings Certificates (BSCs) profit rate downward amid declining inflation and upbeat economic signs with effect from March 1, 2025.

People can buy the Qaumi Bachat’s Behbood Savings Certificates from any nearby branch of the Qaumi Bachat Bank across Pakistan.

Launched in 2003, Behbood Savings Certificates are a financial scheme tailored to the needs of widows, senior citizens, and disabled persons

Read More: Behbood Savings Certificates: Latest profit rate; February 2025

Initially designed for widows and the elderly in 2003, the scheme was extended to disabled persons and special minors with disability (through guardians) in 2004.

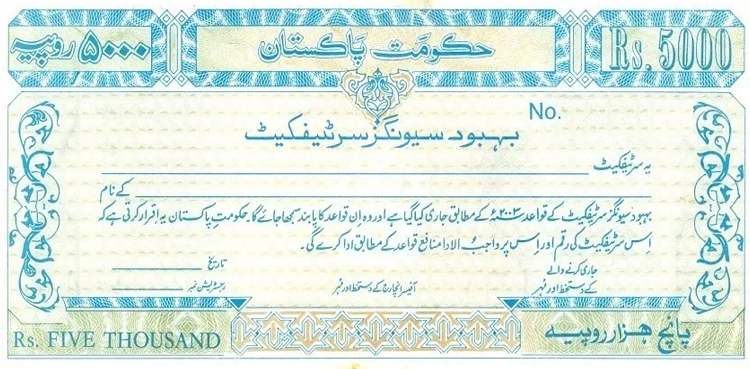

They offer investment options from Rs. 5,000 to a maximum of 75 lakhs, as they provide a secure and profitable way to save. Investors benefit from monthly profit payments directly credited to their linked savings account.

The denominations of the certificates are Rs5,000, Rs10,000, Rs50,000, Rs100,000, Rs500,000, and Rs1,000,000.

Investment Limit

The maximum investment amount for an individual is Rs7.5 million, while the maximum for joint investors is Rs15 million.

Certificates Profit February 2025

The government has set the Behbood Savings Certificate profit rates at 13.58 percent as per the most recent adjustment.

This implies that individuals might make a profit of Rs. 1,131 per month on an investment of Rs. 100,000.

Earlier, the Central Directorate of National Savings (CDNS) reduced profit rates for Regular Income Certificates (RICs), effective from February 14, 2025.

Introduced in 1993, the Regular Income Certificates are designed to meet the monthly financial needs of the general public.

These certificates are available in denominations of Rs50,000, Rs100,000, Rs500,000, Rs1,000,000, Rs5,000,000, and Rs10,000,000.

The revised profit rate on Regular Income Certificates is now set at 11.74 percent (pc), down from the previous 11.88pc. This adjustment means that investors will receive a monthly payout of Rs979 per Rs100,000 investment, compared to the earlier Rs1,010 for Regular Income Certificates.

Despite the cut, investments in Regular Income Certificates remain exempt from Zakat deductions, providing a stable and secure investment option for the public.

The taxation on profits from these certificates depends on the investor’s tax status. Individuals listed in the Active Taxpayer List (ATL) are subject to a withholding tax rate of 15 percent on the yield, while non-filers, not appearing in the ATL, are taxed at a higher rate of 35 percent. These rates are applied uniformly regardless of the investment date or profit amount.

”